Did you know that, according to a study carried out by Nuvemshop, e-commerce grew by 145% in the first half of 2020? And when we talk about values, this growth is even more impressive:

According to statistics, global e-commerce sales will reach 4.9 trillion in 2021, about 265% growth, from 1.3 trillion (2014) to 4.9 trillion ( 2021).

What was already a strong trend, with increasing numbers, even had a much greater growth during this year due to the measures to prevent the new coronavirus, after all, with measures of isolation and social distance, thousands of consumers turned to the internet to make purchases of various products and also services, such as costco auto insurance.

Below, you can see some tips compiled on Portal Segs to succeed in selling insurance online at your brokerage.

Come on?

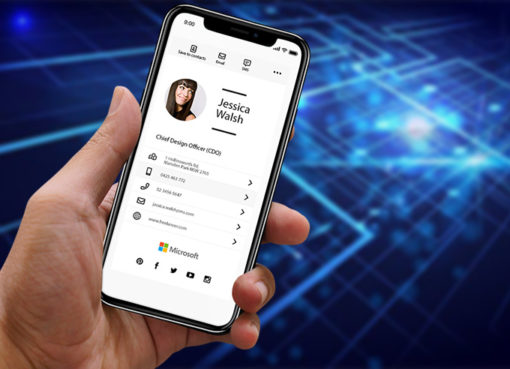

1 – Have a responsive and fast website

Anyone who thinks it’s just putting their website on the air and waiting for it to happen is wrong. On the contrary, putting up an attractive website capable of engaging a significant volume of people requires work and investment. Therefore, one way to sell more insurance online is through a good website.

A fast loading and a mobile version are the first steps to not lose potential customers right away, in addition to improving your organic ranking in web search engines such as Google.

2 – Sell insurance online through technology

The backstage of your business represents everything the customer doesn’t see, e.g., managing quotes, orders, financial reports: make sure everything is working properly.

Therefore, seek to professionalize your operation, especially if you want to scale your business, with adequate management and multi-calculation software.

3 – Security is key

According to estimates by the Brazilian Association of Electronic Commerce (ABComm), one in 45 purchase attempts in virtual stores is illegitimate. To protect yourself, it is recommended to invest in certificates such as SSL (the green padlock) and anti-fraud programs.

Have security seals on your page so that the consumer is more comfortable and feels more secure.

4 – Sell insurance online: Invest in marketing

Content marketing in the insurance area is one of the most used strategies today to increase sales. Share texts, posts, and videos that answer customer questions, from the most general to the most specific.

Content Marketing adds value to the business, strengthens the relationship with the public, and helps the brokerage to become recognized as an authority in its area of expertise.

Make content with tips, examples, promotions, alerts, among other topics.

5 – Always offer good service

Offering quality virtual service is not an option; it is an obligation. Your broker needs to be prepared to meet customer demands, preferably in real-time, or you risk losing sales.

A good option is to have a chatbot to solve the most frequent questions, taking care to pass the service on to an employee if necessary.

6 – Count on Quiver ON!

Quiver ON is a new concept to facilitate your relationship with leads and sell auto, motorcycle, cargo, and home insurance online.

A solution that allows your client to make quotes 100% online, directly on your broker’s website, bringing greater productivity through the automatic distribution of leads and integration with database and multi calculation for you to offer the best quote and control the conditions offered.

Here’s how we can help your broker get on board with Quiver ON:

Customer prospecting

Approach your new customers in a simple and agile way on any digital platform.

Distribution Channels

Improve your fundraising process and define the right channels efficiently.

New Business

Grow your business with personalized and targeted campaigns.

Data Collection

Landing pages with pre-defined customizations according to your needs.