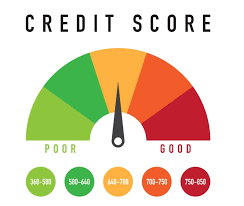

Credit Score Factors: How to Calculate Your Score

There are three major credit reporting agencies in the United States ( Experian, Equifax, and Transunion) that report, update, and store consumers’ credit history. While there may be differences in the information collected by the three credit bureaus, there are five main factors that are evaluated when calculating a credit score: 3

- payment history

- Total amount owed

- length of credit history

- type of credit

- new credit;

Payment history accounts for 35% of a credit score and shows whether a person is paying their debts on time. The total amount owed is 30% and takes into account the percentage of the individual’s available credit currently being used, known as credit utilization. Credit history is 15% long, with longer credit histories considered less risky because there is more data to determine payment history.

The credit type uses 10% of the credit score and shows whether a person has installment credit, such as a car loan or mortgage, and revolving credit, such as a credit card. New credit also accounts for 10%, which takes into account how many new accounts a person has, and how many new accounts have been recently applied for, resulting in; credit inquiries, and when an account was recently opened.

ADVISOR INSIGHTS

Kathryn Hauer, Chief Financial Officer®; EA

Wilson David Investment Advisors, Aiken, SC.

If you have a lot of credit cards and want to close some you don’t use, closing credit cards can lower your score.

Instead of closing them, put away unused cards. Keep them in a safe place in individually labeled envelopes. Go online and check each of your cards. For each, make sure there is no balance and that your address, email address, and other contact information are correct. Also, make sure you don’t have autopay set up on either. In the section where you can alert, make sure your email address or phone number is there. Be sure to check them regularly for fraud, as you won’t be using them. Remind yourself to check every six months or a year to make sure they haven’t been charged and nothing unusual has happened.

How to Improve Your Credit Score

When the information on a borrower’s credit report is updated, their credit score changes and may go up or down based on the new information. Here are some ways consumers can improve their credit scores: 7 4

- Pay your bills on time: It will take six months of on-time payments to see a noticeable difference in your score;

- Increase your credit limit: If you have a credit card account, call to inquire about a credit increase. If your account is in good standing, your credit limit should be raised. It is important not to spend this money so that you keep your credit utilization rate low.

- Don’t close credit card accounts: If you don’t use a credit card, it’s better to stop using it than to close the account. Depending on the card’s age and credit limit, it can hurt your credit score if you close your account. Let’s say you have $1,000 in debt and a $5,000 line of credit split equally between two cards. Depending on the account, your; credit utilization rate; is 20%, which is good. However, closing one of the cards will put your credit utilization at 40%, which will negatively affect your score.

- And a best credit repair company: If you don’t have time to improve your credit score, a credit repair company will negotiate with your creditors and three credit bureaus on your behalf in exchange for a monthly fee. Also, given the number of opportunities a great credit score offers, it pays to take advantage of one; the best credit monitoring service; to keep your information safe.

Bottom line

Your credit score is a number that can cost or save you a lot of money over your lifetime. A good score can get you a lower interest rate, which means you’ll pay less on your line of credit. But it’s up to you, the borrower, to make sure your credit remains strong so you have more opportunities to borrow money if you need to.