Introduction

When it comes to owning a car, having proper insurance coverage is essential. Car insurance provides financial protection in case of accidents, theft, or damage to your vehicle. However, finding the best car insurance rates can be a daunting task for many people. With so many insurance providers and policies available, it’s important to know how to navigate through the options to get the most affordable and suitable coverage for your needs. In this article, we will explore various strategies and tips to help you find the best car insurance rates.

Factors affecting car insurance rates

Before diving into the process of finding the best car insurance rates, it’s crucial to understand the factors that influence insurance premiums. Insurance companies take into account several aspects when calculating the cost of your policy. These factors include your age, driving record, location, type of vehicle, credit score, and coverage options. Being aware of these elements will help you make informed decisions while searching for affordable car insurance rates.

Understanding coverage options

To find the best car insurance rates, it’s important to have a good understanding of the different coverage options available. Insurance policies typically include liability coverage, which pays for damages to others if you’re at fault in an accident, and comprehensive and collision coverage, which protect your own vehicle. Additionally, there are optional coverage options such as uninsured/underinsured motorist coverage, medical payments coverage, and rental car reimbursement. Evaluating your needs and determining the appropriate coverage will enable you to find the best rates for your desired level of protection.

Tips for finding the best car insurance rates

- Compare multiple insurance quotes: Obtain quotes from different insurance providers to compare prices and coverage options. Online comparison tools can simplify this process and help you find the best rates.

- Utilize discounts and savings: Many insurance companies offer discounts based on various factors such as safe driving records, multiple policies, vehicle safety features, and good grades for student drivers. Take advantage of these discounts to reduce your insurance costs.

- Maintain a good driving record: Having a clean driving record can significantly impact your car insurance rates. Avoid accidents, traffic violations, and claims to keep your premiums low.

- Review customer feedback and ratings: Before selecting an insurance provider, research customer reviews and ratings to gauge their reputation and customer satisfaction levels.

- Seek advice from insurance agents: Insurance agents can provide valuable insights and guidance while helping you navigate through different policies. They can also assist in finding the best rates based on your specific requirements.

Comparing car insurance quotes

When searching for the best car insurance rates, it’s crucial to compare quotes from multiple providers. Each insurance company has its own pricing structure, coverage options, and discounts. By obtaining quotes from different sources, you can identify the most competitive rates for the coverage you need. Online tools and websites simplify the process by allowing you to enter your information once and receive multiple quotes from various providers.

Utilizing discounts and savings

Insurance providers often offer discounts and savings opportunities that can help lower your car insurance rates. These discounts can vary from company to company, but some common ones include:

Safe driver discounts for maintaining a clean driving record.

Multi-policy discounts for bundling your car insurance with other policies, such as homeowner’s insurance.

Vehicle safety feature discounts for having features like anti-lock brakes, airbags, or anti-theft devices.

Good student discounts for students who maintain a certain GPA.

Low-mileage discounts for drivers who don’t use their vehicles frequently.

By exploring these discounts and taking advantage of the ones applicable to your situation, you can save significantly on your car insurance premiums.

The importance of a good driving record

Maintaining a good driving record is crucial when it comes to finding the best car insurance rates. Insurance companies consider your driving history and assess the risk you pose as a driver. Drivers with a history of accidents, traffic violations, or DUI convictions generally face higher insurance premiums. On the other hand, drivers with clean records are often eligible for lower rates. By practicing safe driving habits and avoiding violations, you can improve your chances of securing more affordable car insurance rates.

Reviewing customer feedback and ratings

When searching for car insurance, it’s important to consider the experiences of other customers. Online reviews, ratings, and testimonials provide valuable insights into the quality of service offered by insurance providers. By reading feedback from existing or past customers, you can gauge the level of customer satisfaction, claims handling efficiency, and overall reputation of the insurance company. Opting for an insurer with positive feedback and high ratings can increase the likelihood of receiving the best car insurance rates while ensuring reliable coverage.

Seeking advice from insurance agents

Insurance agents are professionals who specialize in helping individuals find the right insurance coverage. They have extensive knowledge of the insurance industry and can provide expert advice tailored to your specific needs. By consulting with an insurance agent, you can discuss your requirements, ask questions, and gain valuable insights into available policies and rates. An agent can guide you through the process, assist in comparing quotes, and help you find the best car insurance rates based on your circumstances.

Checking for reputable insurance companies

Choosing a reputable insurance company is vital when it comes to securing the best car insurance rates. Look for insurance providers with a strong financial standing, a history of prompt claims handling, and a good reputation within the industry. Independent rating agencies such as A.M. Best, Standard & Poor’s, and Moody’s provide ratings and evaluations of insurance companies. By considering these ratings and researching the company’s track record, you can ensure that you’re dealing with a reliable insurer that offers competitive rates.

Researching state-specific requirements

Each state has specific insurance requirements that drivers must meet. Researching and understanding these requirements is essential when looking for the best car insurance rates. State mandates often include minimum coverage limits and may have additional regulations or options to consider. By familiarizing yourself with the laws in your state, you can make informed decisions regarding the coverage you need and avoid any potential penalties for non-compliance.

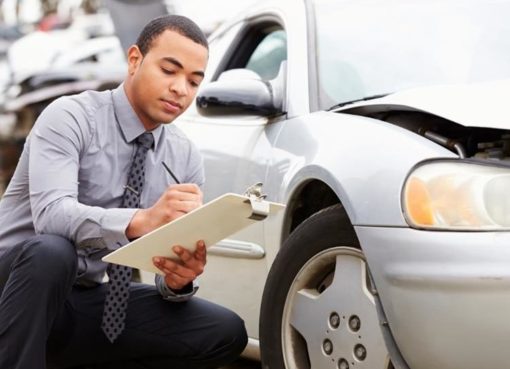

Understanding the claims process

When evaluating car insurance providers, it’s important to consider their claims handling process. In the unfortunate event of an accident or damage to your vehicle, you want an insurance company that provides efficient and reliable claims assistance. Look for insurers that have a straightforward and accessible claims process, including online claims filing and 24/7 customer support. The ease and efficiency of the claims process can have a significant impact on your overall experience with an insurance provider.