Almost all of us have heard of SR22 insurance, what is this Insurance and how much SR22 insurance costs. If you want to know more about SR22 insurance, then read the complete article.

What is an SR-22?

An SR-22 is authentication of insurance that demonstrates you convey car insurance in case you’re involved in a car accident.An SR-22 is certainly not a real type of insurance, but a form filed with your state. This form shows that you are meeting your state’s minimum auto liability insurance prerequisites.

When Do You Need it?

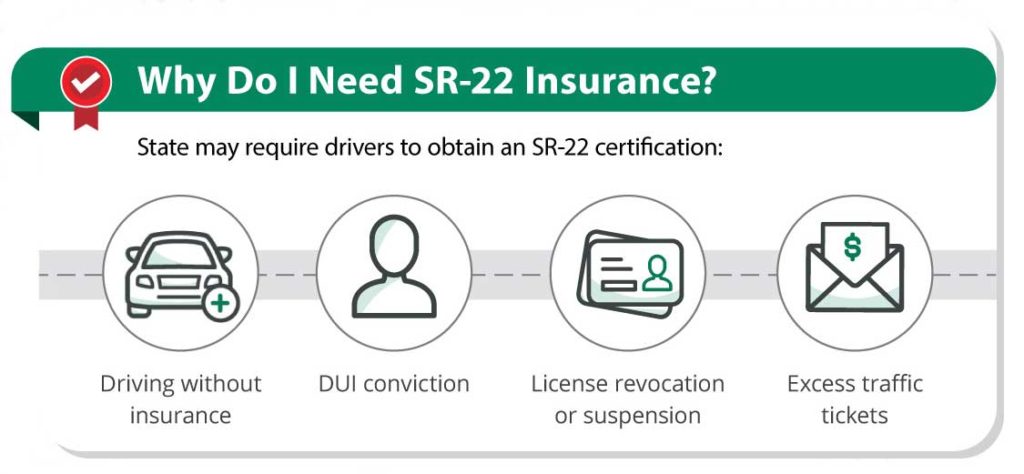

Few out of every odd driver needs an SR-22 because it is ordered by a court. Each state has its particular prerequisites. However, as a guideline, drivers with at least one of the accompanying infringements on their new driving record will probably require an SR-22:

- Drivers who collect too many moving infringement in a brief timeframe.

- You’ve been indicted for DUI, DWI or another genuine moving infringement.

- Causing a mishap while driving without insurance.

- Not paying court-requested child support.

- Your driving license has been suspended or renounced.

How much SR-22 insurance cost?

Filing an SR-22 with your state commonly costs about $20 to 30. The expense might shift by state and the insurance agency. Since your auto insurance agency will file the SR-22 for you, the insurer will then give the expense to you in a bill.

It’s a one-time filing fee. Nonetheless, assuming your insurance policy lapses slips and you buy new coverage, you’ll need to pay the charge again and your new guarantor should send proof of coverage to your state.

The expense of SR22 varies between insurance agencies. An individual can hope to spend a normal of $300 to $800, contingent upon elements like individual driving history, age, driving experience, conjugal status, and a spot of home.

A similar guarantor might offer different SR-22 rates across different states, so looking at rates between numerous insurance agencies is a good method for ensuring you’re getting the best arrangement