- Choose If You Need Full Coverage Car Insurance

- What insurance company has the best rates?

- Car Insurance Quotes Comparison

- Which insurance company is best for car insurance?

- Cheaper Auto Insurance For Military Or Nonmilitary Drivers

- Who has the best car insurance prices?

- What is the best car insurance comparison site?

Contrast Auto Insurance Options With Find Your Best Rate

Compare Auto Insurance Options To Find Your Best Rate

Generally, you’ll be required to have no less than liability insurance coverage. For instance, a a hundred/300/50 liability coverage would cowl up to $100k for bodily injury per person, $300k for bodily harm per accident and $50k for property harm per accident. Liability coverage comes into play should you cause an accident that harms another person (bodily injury coverage, or BI) or damages property like a home or fence (property injury coverage, or PD). Personal injury protection (PIP), or “no-fault” insurance coverage, covers accidents to you or your passengers, even should you have been driving (because unhealthy things happen to awesome people). This coverage is essential in case you have so-so health coverage or tote passengers in your automotive.

Choose If You Need Full Coverage Car Insurance

Shopping round yearly or two is the best way to avoid this follow and it’ll assist you to find the most cost effective automotive insurance coverage options. For most automobile insurance coverage companies, getting a quote is a straightforward, online process that you are able to do in minutes.

If you’re aged between 17 – 24 then we’ve got some good news for you…car insurance has dropped by £80 over the past six months🚗Check out our online tool to see how your running costs compare to others: — Compare The Market (@comparethemkt) August 7, 2020

Analyze Minimum And Full Coverage Car Insurance Rates In Your State

This is true, as a result of statistically males are more likely to engage in dangerous driving practices like rushing and driving beneath the influence, which ends up in extra accidents. Massachusetts, Hawaii, and North Carolina don’t allow gender to play a task in auto insurance charges, so drivers in those states don’t have to worry.

What insurance company has the best rates?

Best cheap car insurance: Geico

In our investigations of top vehicle insurance agencies, Geico reliably offers the least rates for most drivers. As a Berkshire Hathaway organization, Geico has earned the top A.M. Best financial rating and second highest market share, 13.8%, in the United States.

Look at Car Insurance Rates For Good And Bad Credit By Company

Because of that, there isn’t one greatest car insurance company that’s the proper fit for every driver. Car insurance coverage is regulated on a state stage and protection costs can vary based mostly on where you live. Meaning your pal or neighbor may pay a special quantity primarily based on their location, chosen coverage and driving historical past.

Look At Car Insurance Rates For A Clean Record And To Blame Crash In Your State

Mobile-pushed packages like Drive Safe and Save and Steer Clear can help drivers get monetary savings on their car insurance coverage by demonstrating safe driving habits. State Farm’s insurance premiums tend to be more expensive than opponents, but profiting from value financial savings instruments could lower your price. J.D. Force ScoreAM Best RatingBBB RatingSimpleScore5 out of 5A++B+four.6USAA is a very positioned protection firm that gives a couple of the best accident protection inclusion inside the nation. The firm is thought for its top-notch customer service, which can be hard to seek out within the insurance business. In addition to great service, USAA additionally offers extensive coverage and good discounts for drivers who want to get monetary savings.

Car Insurance Quotes Comparison

Erie makes hitting the road somewhat simpler for young drivers, with a great deal of advantages that may also put their mother and father’ minds comfortable. All Erie insurance policies embrace roadside help and rental car coverage and pay up to $350 for personal items broken in an auto accident. Standard policies additionally pay as much as $500 per pet in case your fur baby sustains an harm while driving in your car and as much as $seventy five for locksmith companies, when you carry collision or comprehensive coverage.

Collision Protection Quotes Comparison: Before And After Insurify

Auto and Home Insurance Bundle Quotes #AutoandHomeInsuranceBundleQuotes #HomeandAutoInsuranceBundleQuotes #PremierShieldInsurance #Auto #Home #Bundle #Quotes — Premier Shield #Insurance Auto Home Business Flood (@HomeAutoQuotes) May 28, 2020

or the place you are going, it’s important that you’ve got automotive insurance coverage from one of the best auto insurance coverage firms — and never just because it is the law in forty eight of the 50 states. A automotive insurance policy protects you in case of property injury or bodily damage liability should you’re in an accident. Some automobile insurance companies have coverage options that even embody roadside help or that can be bundled with homeowners insurance, when you have a house. Depending on the insurance coverage product you determine on, you could have full protection or limited protection, though most states require that your minimum protection contains liability insurance.

The Fastest Way To Compare Quotes

When comparing quotes drivers also needs to embrace provides from smaller local or regional insurers. There are many factors that come into play for car insurance charges.

You’re right, Wynne, that does put a smile on our face 😊 Compare car insurance now at — GoCompare (@Gocompare) August 6, 2020

Amount Of Insurance Claims

Use the automotive insurance comparison device to compare automobile insurance quotes from a wide range of firms to get an inexpensive deal. Read the Key Features document to make sure that it additionally presents all of the proper protection for you so it pays out when you need it. We always offer the identical flexible rate plans and outstanding customer service, no matter your driving report. Most people select their automotive insurance based mostly on worth alone, but it’s not the only issue you should think about.

If you’re aged between 17 – 24 then we’ve got some good news for you…car insurance has dropped by £80 over the past six months🚗Check out our online tool to see how your running costs compare to others: — Compare The Market (@comparethemkt) August 7, 2020

Accident Rates

There’s additionally a cellular app for submitting claims, managing coverage and getting assist. In addition to auto insurance, Geico provides umbrella liability coverage and insures motorcycles and all-terrain automobiles. Auto insurance coverage discounts are available to prospects who purchase other policies, such as residence insurance coverage, from firms which have partnerships with Geico. Premiums are assuming a full protection coverage of a 30-12 months-old who drives a 2017 Honda Civic.

Which insurance company is best for car insurance?

AAA Mature Operator courses are cautious driving courses intended to meet the data needs and interests of senior drivers more than 55 years old. Drivers who effectively complete the driver improvement program additionally may be qualified to get protection premium limits.

Compare Car Insurance For Teen Drivers, Middle Aged Drivers, Or Senior Citizens

Auto and Home Insurance Bundle Quotes #AutoandHomeInsuranceBundleQuotes #HomeandAutoInsuranceBundleQuotes #PremierShieldInsurance #Auto #Home #Bundle #Quotes — Premier Shield #Insurance Auto Home Business Flood (@HomeAutoQuotes) May 28, 2020

Before you buy automotive insurance coverage, evaluate your state’s car insurance laws and then compare rates, policies and firms on-line to search out the best protection on your wants. Read 171 Reviews SAFECO Auto Insurance, in enterprise since 1923, provides car insurance policies that meet the needs of individuals with numerous incomes and coverage wants. The company presents support services through its web site and toll-free number.

What are the cheapest car insurance?

Allstate offers senior limits for those more established than 55, or working low maintenance. Dairyland gives a pay-more only as costs arise choice that is ideal for seniors who may have been denied standard protection, and Metromile is a modest option for the individuals who drive rarely.

Is Auto Insurance Cheaper For Homeowners Or Non-householders?

It is determined by your driving record, where you live, your budget and the coverage choices you are thinking about. But the seven companies listed above are all reputable insurers with a protracted historical past of providing quality service, so you’ll be able to’t go incorrect when you choose one of them. Get quotes from several firms and compare them before you buy to see which offers you probably the most reasonably priced rates in your car insurance.

Cheaper Auto Insurance For Military Or Nonmilitary Drivers

Indeed, you ought to be a guaranteed driver to have the option to drive a rental vehicle. If you’ve private automotive insurance, you must check to see whether it covers rental automobiles (and make sure to ask if there are any restrictions, similar to vehicle measurement or worldwide pickups). If you don’t have personal insurance coverage, think about checking your bank card – it could provide a rental automobile coverage should you use it to pay for the rental. Any damages, repairs, or litigation settlements past that quantity will turn into out-of-pocket bills, making you personally liable.

- Active navy members, veterans and their qualified family members can’t find a higher auto insurance coverage firm than USAA.

- Depending on the insurance coverage product you decide on, you would have full coverage or restricted protection, though most states require that your minimum coverage consists of legal responsibility insurance coverage.

- That’s why automobile doing a car insurance coverage comparison will prevent money.

- You can’t spare on the off chance that you don’t store around and assess protection cites.

- After the base fee is determined, automobile insurance coverage prices depend upon how every firm views your driver profile.

- Insurance firms set your charges using their very own distinctive calculations.

- Some car insurance corporations have protection choices that even embody roadside help or that may be bundled with homeowners insurance, if you have a house.

- or the place you are going, it’s essential that you’ve got automobile insurance coverage from top-of-the-line auto insurance coverage firms — and never just because it’s the regulation in 48 of the 50 states.

- Compare auto insurance coverage quotes so yow will discover out which company presents the protection you want at the price you need to pay.

Auto Insurance Quote Comparison Made Easy.

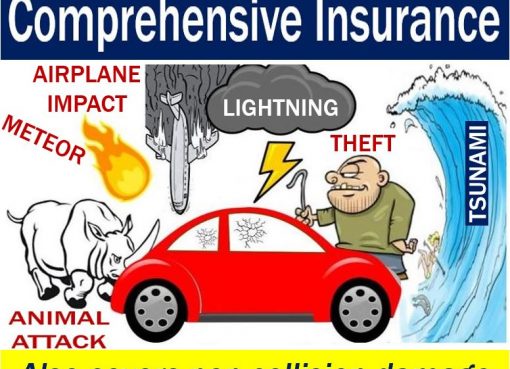

Collision protection particularly protects in opposition to collision or rollover damages, no matter who brought on the accident. Comprehensive automobile insuranceprotects you from the sudden, corresponding to hail injury, fire, flooding, theft, vandalism, etc. Neither of those are required by any state, but they’re often two widespread add-ons by drivers. This type of automobile insurance covers the proprietor in case of any legal liability owing to demise or harm to any particular person or damage to any property attributable to the insured vehicle.

You Could Be Saving Up To $359 Per Year ($1,031 If You’re An Extra Safe Driver).

We attempt to get your declare resolved and paid inside seven business days. If you currently have automobile insurance coverage, how are you aware you’ve the most effective safety?

Who are the top 5 insurance companies?

You should drop full inclusion protection on your vehicle when the expense of the protection charges approaches or surpasses the potential payout, should a secured occasion happen. For example, an older car with high mileage may not be worth costly repairs, and you might want to save for a new car instead of paying for extra insurance.

Easily compare car insurance premiums with this free service — New York Post (@nypost) July 24, 2020

Know about How Your Credit Score Affects Your Insurance Rate.

Who has the best car insurance prices?

Best cheap car insurance overall: Geico

Geico not only offers the best rates in our analysis for 40-year-old drivers with a clean driving record, but also has the lowest average rates for: Good drivers with poor credit.

What you might not know is that the corporate is actually one of the largest automotive insurers on the earth. If you are a client who is simply in search of fundamental auto insurance and nothing else, then AAA Auto Insurance might be not for you. However, if you like the extras in car insurance protection, there are many attractive reductions out there to membership members. Whether the advantages are price the price of membership membership depends upon how much you need out of your car insurance coverage company. You can select from any of the above-mentioned car insurance coverage corporations and select the best motor insurance coverage in India that offers you maximum protection benefits at a nominal premium.

If you’re thinking of switching car insurance coverage corporations and need to make sure you get the most effective protection in your wants, listed here are the steps you must follow. By and enormous, senior drivers receive a few of the lowest car insurance premiums and have entry to a few of the greatest out there discounts from car insurance companies. Although it can be exhausting to determine which car insurance coverage firm would be the one to belief throughout your retirement, this listing can information you in the right course and assist you to lower your expenses. Just make sure to think about your wants and search for the corporate that best fits your requirements and price range.

All states have minimal automobile insurance requirements regarding legal responsibility coverage. Some states even require under-insured or uninsured motorist coverage in addition to personal harm safety (PIP).

Remember that insurance coverage corporations look at a variety of factors when figuring out your rate, similar to your age, the automobile you drive, your zip code and your credit score. Many automobile insurance firms will provide you with a discount when you have other policies with them. The commonest policies for bundling are home and auto insurance coverage.

The state where you live, and even your neighborhood, influences how a lot you pay for auto insurance! Moving into a secure neighborhood could save you cash on car insurance coverage, likewise, relocating to a giant city may cause your price to go up. Your ZIP code tells us tips on how to start matching you with the best insurance firm on your situation.

What are the worst insurance companies?

Company Ratings

AAA Auto Insurance has an “A+” rating with A.M. Best insurance rating organization. The organization positioned third in a 2016 J.D. Force and Associates Purchase Experience Customer Satisfaction overview. The Better Business Association’s (BBB) rating differs by affiliation.

My latest blog explains why #digitaltransformation will become a top priority for insurers, with #seamlessonboarding and robust #IDverification playing a critical role in the shift towards faceless servicing: #digitalinsurance #insurance #insurtech — Robin Wagner (@RobinAWagner) July 17, 2020

This firm sells householders, life and other kinds of insurance, along with auto insurance. Insurance is available for all types of automobiles, including traditional automobiles. Safe drivers obtain discounts for good driving conduct tracked through an app.

Swerving to keep away from the animal and hitting one thing else wouldn’t fall beneath comprehensive protection. The standard car insurance policy could not cover driving for a riding sharing app. So before you jump on this fast method to earn cash, check your coverage to see when you’re lined. If not, you can add coverage via your present insurer or add rideshare protection in case your insurance coverage firm provides it.

The good news is that you could truly decrease your insurance coverage costs should you preserve a secure driving report or work on your credit score — or your grade point common. AAA’s required limits of protection for auto policies comply with the authorized requirements of every state. Members might buy legal responsibility, complete collision, medical protection, uninsured motorist coverage, and rental automotive reimbursement. Auto policy reductions are available for multi-line policy, safety options and a good driving low cost. In the event that an AAA part has a mishap including one other AAA part, the $250 deductible is postponed.

It might be easier to only stick to what you understand, however it pays to look at the competition and evaluate quotes from multiple insurance coverage companies. While some auto insurers provide loyalty reductions, in some cases, you can pay much less by switching providers. We’ll help you determine which choice offers you the right protection at the most effective worth. Drivers ought to evaluate quotes from at least two or three insurers.

The company has a variety of frequent automotive insurance coverage discounts and free automotive insurance coverage quotes on-line — so you could chip away at your premiums and save month to month that method. But in case you have a decrease credit score and a driving document with a few blemishes, you’ll pay extra with Allstate. If you’re a excessive-threat driver you can save with a policy from The General, however your rates will still increase in case you have an extra accident or moving violation. Safe driving remains essentially the most dependable means to save cash, long term, on auto coverage.

You might discover other insurers don’t rate as harshly for getting older drivers as your current one, or discover who you have is still your best option. J.D. Force ScoreAM Best RatingBBB RatingSimpleScore4 out of 5A++A4.4State Farm is a ground-breaking protection inclusion organization in general. The firm is consistently ranked highly and has impressive financial strength ratings. Of the suppliers we evaluated, we felt that State Farm provided the best mobile and online instruments. Its highly rated mobile app allows drivers to handle their policy, report a declare, make a payment, and more.

Easily compare car insurance premiums with this free service — New York Post (@nypost) July 24, 2020

If you’re touring to multiple international locations, simply enter the first Country of Travel into the quote kind! Yes, additional drivers who are on the rental agreement with you are coated freed from charge. You do not want to tell us of the extra drivers’ names, as they are coated mechanically, no matter age, nation of residence, and so forth. Please note that the rental company may cost a small “further driver” fee. We take the stress out of the claim process with concierge-degree service.

Generally, age-related car insurance reductions begin at age 50 and enhance every 5 years. Allstate was one of the uncommon automotive insurance coverage firms ranked on every single considered one of J.D. Force’s local consumer loyalty records – and was No. 1 in Florida. When purchasing for a coverage, it’s smart to consider a variety of decisions, from the nation’s largest auto insurance companies to smaller, regional insurers which may be a great match for you. Take a look at the massive image of customer satisfaction, claims service and value.

J.D. Power ScoreAM Best RatingBBB RatingSimpleScore3 out of 5A+A+four.2Progressive stands out for its extensive lineup of insurance reductions. Unlike some firms, Progressive offers reductions that many drivers are able to reap the benefits of. However, the corporate’s customer support ratings are typically low. Nationwide presents a full range of normal coverages, along with great optional coverages, together with accident forgiveness and vanishing deductible.

Getting motor insurance is important for all of the car/automobile homeowners and drivers in India. It is mandatory to have third get together automobile insurance coverage in India under the Motor Vehicle Act, 1988. But it is recommended to get complete insurance in your car. To prime it up, each insurer presents a bunch of priceless add-ons on the basic plan to make the protection much more effective. USAA provides on-line quotes and a mobile app for paying payments, filing claims or downloading insurance coverage cards.

What is the best car insurance comparison site?

Insurify is the top of the line and most-evaluated vehicle protection quote examination site in America. With a 4.8/5 consumer loyalty rating on Shopper Approved, Insurify makes sure about a large number of dollars in shut auto strategy investment funds each day for clients in every one of the 50 states. Established in 1936, Geico initially offered protection exclusively to government representatives and military individuals. Today, Geico provides insurance merchandise from coast to coast and employs over 40,000 folks. Following a couple of easy suggestions might help you get the bottom potential price without compromising in your coverage. Auto insurance companies provide a number of reductions, which may lower your rate. Similar to motorcycle insurance coverage or an prolonged automotive warranty, auto insurance coverage quotes are highly personalised, so choosing the most effective company to work with is not always easy.

For example, you might find that you simply’ll be driving less or investing in a newer, safer car whenever you retire—and which will lower your insurance coverage rates. And as we now have famous here, some companies supply reductions particularly for people in retirement or present age-specific reductions. For these causes it’s at all times a good suggestion to shop round for automobile insurance coverage when you retire or go through any main life event.