What is a declaration page for car insurance? It is an important component of car insurance policy which includes personal information such as your name, birth date, license number and many more.

What Is An Auto Insurance Declaration Page?

Proof Of Insurance

Car insurance coverage is a sort of insurance policy that effectively takes care of expenses arising from unfortunate occasions similar to an accident theft and any third get together legal responsibility. Quickly learn solutions to your questions relating to allianz eire automotive insurance coverage. Some insurance coverage companies concentrate on the bare necessities so that you can drive legally bodily harm and property damage legal responsibility with the minimum limits along with a claims process thats spotty at finest. So having “full protection” is probably not the identical as having an amount of protection which covers your potential threat.

- What is a declaration page for car insurance?

- How do you read an insurance declaration page?

- Letter 1: Sample Insurance Claim Letter By Beneficiary After The Death Of Policyholder

- How do I read my insurance card?

- What does homeowners declaration page look like?

- What is considered proof of auto insurance?

- What is a declaration page for car insurance policy look like?

Where Do I Find My Insurance Declarations Page(s)?

What is an auto insurance declarations page?

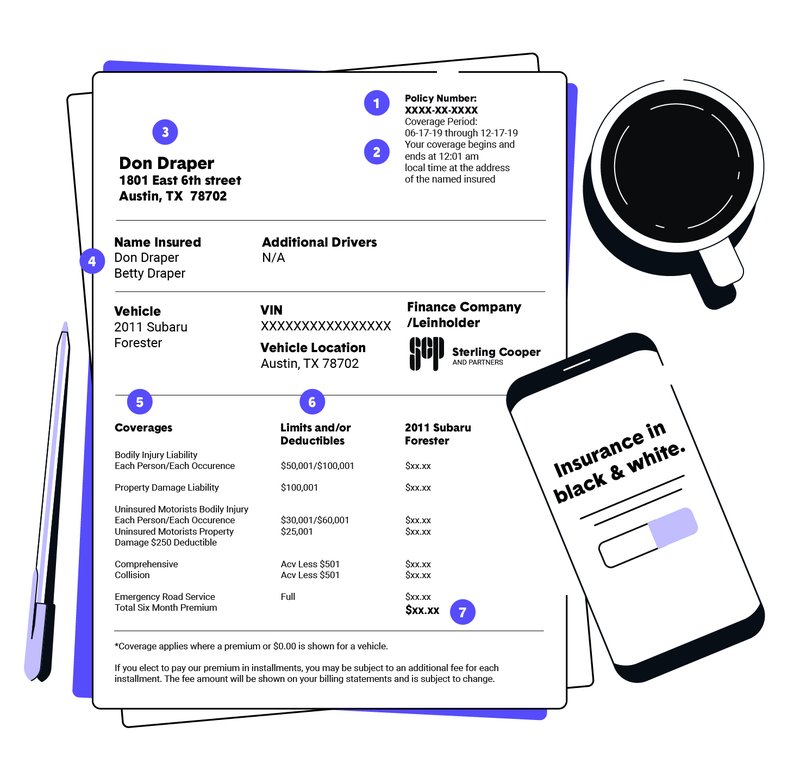

Revelations — the first page (or pages) of an approach that determines the named guaranteed, address, strategy period, area of premises, strategy limits, and other key data that changes from insured to insured. The revelations page is otherwise called the data page.

What is a declaration page for car insurance?

A declaration page is basically a summary of the auto insurance coverage protection you could have. It will present you which autos are covered, which drivers are insured, what coverage you have on every of the essential components of an auto insurance coverage policy (and the levels you are carrying on every half). And for these of you who financed your vehicle, it’ll also present if a lienholder is listed. While most enterprise makes use of of a personal car are coated by a personal auto insurance policy, not all enterprise uses are.

Identify Your Coverage

Even a easy typo that incorrectly lists your birthday, driver’s license number, or car identification quantity could prove a serious headache must you ever need to make a claim. If you don’t see any of those listed on your declarations web page but are interested in including them to your coverage, discuss to your car insurance company.

+ Agent Selection

Insured vehicles with full VINs are clearly indicated. Children and other non-driving family members are sometimes listed on the declarations web page as secondary coverages corresponding to accidental demise and dismemberment could apply to them. If you’ve got ever taken a detailed look at your auto insurance coverage coverage, you may have observed the term actual money worth. It’s on the declarations web page, usually subsequent to “Collision” or “Other Than Collision,” should you opted to add these coverages to your coverage.

Policy Number

There are some instances by which you’ll need to offer a proof of insurance card before your insurance firm has accomplished the paper work, in particular when you are shopping for a new automobile. Since many states has adopted a coverage of not allowing drivers to take the highway with out this card this has turn into particularly important to drivers. When taking possession of a brand new car, whether or not from a supplier, or a non-public party, you need to be conscious of the method on the way to go about getting an insurance card.

Inclusion Amounts, In And Out Of Network, And Co-pays

How do you read an insurance declaration page?

A collision protection assertion page is an outline of your auto strategy gave by your accident coverage supplier. This page will incorporate the accompanying data: Name of your vehicle protection supplier. Policy number. Determined vehicles secured by the approach and data portraying those vehicles.

Comprehensive insurance coverage coverage help pays for damage to your automobile not coated by collision. Even should you buy the most coverage out there, you’ll have to dig into your pockets after an accident earlier than your insurance coverage company pays out. Each kind of physical harm protection you opted for has a special deductible, which is the quantity you’re answerable for paying before your insurance coverage kicks in to cowl prices.

Claim Letter To Insurance Company

Does the DMV check your insurance?

thing. the demonstration of pronouncing; declaration: a statement of a profit. a positive, express, or formal articulation; decree: an assertion of war. something that is announced, avowed, or proclaimed. a document embodying or displaying an announcement or proclamation: He posted the declaration in a public place.

When you’re concerned in an accident with an uninsured, underinsured, or phantom motorists, your insurance firm must pay for damages that are not lined by the opposite motorist’s policy. A car insurance claim is a process wherein an insured asks the car insurance firm to compensate himher for the damages which might be sustained by hisher car after an accident. Get cashless automotive insurance policy with rsa garage money cowl services. You can buy auto insurance in case you cause an automobile accident and you may be answerable for the losses of other people involved.

Letter 1: Sample Insurance Claim Letter By Beneficiary After The Death Of Policyholder

TermDefinitionAdditional insuredA household member of the policyowner, who is also covered by the coverage as a driver — typically all licensed drivers within the residence apart from the primary driver. At-fault accidentA crash that you simply trigger, both partially or utterly. Car insurance quotesAn estimate of how a lot an organization will cost you for automobile insurance.Collision coveragePays to repair your car should you cause a crash or have a one-automotive accident, corresponding to hitting a tree. If your car repairs cost $5,000 and your deductible is $500, you will get a declare check for $four,500.

How would I get a State Farm protection affirmation page?

Protection data isn’t submitted to DMV inside 30 days of being given an enlistment card. DMV is informed that the vehicle’s protection strategy was dropped and a substitution strategy isn’t submitted inside 45 days.

License Plates, Decals, & Placards

Bodily Injury comes into play if and when you trigger an accident and you injure or kill somebody whereas driving your car. Bodily Injury protection may also make certain your car insurance will provide a legal defense for you if another party information a lawsuit in opposition to you due to an accident you triggered. So, let’s say you cause an accident and as a result, two other individuals are significantly injured. Auto insurance is a crucial a part of a wise financial technique. Not only does it help shield your automobile, however it also might help pay for medical payments after an accident, guard against damages from a lawsuit, defend you from uninsured or underinsured drivers, and extra.

Insurance Requirements

This is completed because statistics present that individuals who have a greater credit score historical past file lesser claims that individuals who make late funds. If you’re on the lookout for an affordable premium value, you will be very pleased you have a great credit historical past when taking out car insurance coverage. To make sure you’re getting a great auto insurance coverage coverage, it’s important to know the way to learn an auto insurance coverage coverage. You can’t be sure that you’re getting the auto insurance coverage you want with out understanding auto insurance coverage itself.

License Or Identification Card Replacements

Those are expenses you incur to carry out companies you usually would have performed had it not been for the damage. Liability protection supplies specific limits capping the quantity your insurance company will pay. For example, your declaration web page may determine your legal responsibility coverage with the quantity sequence one hundred/300/25. This implies that for bodily injury, you are lined as much as $a hundred,000 per person but up to $300,000 per prevalence (accident), no matter how many people are injured.

Ab 60 Driver Licenses

How do I read my insurance card?

Vehicle insurance agencies will educate the DMV about the slipped by strategy and you will get a letter from the DMV and the insurance agency illuminating you about this. They will have the option to check your verification of protection promptly and capture you or fine you on the spot.

Your own insurance coverage company makes the payments and the coverage limits and deductibles you choose determine the amount you possibly can collect. Some states additionally require reimbursement for substitute companies.

Vehicle Industry Services Contact Info

- Liability coverage is insurance that covers damage you cause to different folks and their property.

- TermDefinitionAdditional insuredA household member of the policyowner, who can be covered by the coverage as a driver — sometimes all licensed drivers in the house aside from the primary driver.

- As instructed above, it might be clever to hold protection in excess of the minimum limits.

- Car insurance quotesAn estimate of how much a company will charge you for automotive insurance.Collision coveragePays to fix your car should you cause a crash or have a one-car accident, corresponding to hitting a tree.

- When referring to legal responsibility limits, the insurance coverage trade makes use of an abbreviation that may be confusing.

- If your car repairs value $5,000 and your deductible is $500, you may get a claim verify for $4,500.

- At-fault accidentA crash that you just trigger, both partially or completely.

What does homeowners declaration page look like?

A mortgage holder assertions page records protection inclusions, cutoff points and deductibles. This incorporates inclusions for the home, individual property, unattached structures, individual risk, clinical costs and lost use advantage.

If you have $one hundred,000 in protection for one sort of protection, that’s the maximum amount – the limit – that the automotive insurance coverage company is obligated to pay. If you don’t have your declarations web page, name your car insurance coverage company to request a duplicate. You may also have the ability to entry it online via your carrier’s web site or app. When you make a change to your protection, your carrier should send you a brand new declarations web page.

Autonomous Vehicles

There’s no shame in not knowing what sure terms or sections imply in a automobile insurance coverage policy, but you’ll want to know what they imply and how they affect you. You’d hate to get into a automotive accident to then realize you don’t have the kind of plan or quantity of coverage that can help pay for it. Here’s a quick rationalization on what to anticipate in an auto insurance coverage coverage and what it means to you. Large numbers corresponding to liability limits are sometimes expressed in 1000’s. The time period “full coverage” could be misleading because there are a number of optionally available coverages – along with legal responsibility protection – you could buy.

Driver Training Schools

Auto insurance coverage dec pages additionally record the insured automobiles and drivers, while householders dec pages record the location of the property you’re insuring. PLPD, or Public Liability and Property Damage, refers back to the minimal state required liability limits of auto insurance on a vehicle.

Reinstating Your Vehicle Registration

Comprehensive coverage is restricted by the market value of your automobile. Your coverage may not cover the complete value of the injury if it is larger. If your automobile is worth $5,000 but has $10,000 value of hailstorm damage, you’ll solely be eligible for $5,000.

It lists the full legal name of your insurance company, the quantity and kinds of coverage, the deductibles, and the car(s) insured. Also, you have to have legal responsibility protection to register your automobile. Your insurance firm tells the California Department of Motor Vehicles (DMV) if you purchase auto insurance coverage or if you cease paying your premium. Your declarations page is designed to offer a primary overview of your automobile insurance coverage coverage.

What is considered proof of auto insurance?

Confirmation of protection (POI) is any sort of documentation that an individual can give to another individual demonstrating that the individual has legitimate protection with an insurance agency. The most well-known type of a POI is a paper card gave by the insurance agency posting strategy data and compelling dates.

Your insurance company will routinely subtract your deductible quantity from your declare. Utilizing the above model, you’d exclusively be qualified for $4,500 with a $500 deductible.

Research Cars

Collision protection is essential as a result of this implies your automobile insurance coverage company can pay for any car damage that occurs to your individual automotive because of a car wreck. After the Bodily Injury (BI) coverage, the following coverage typically listed is the uninsured and/or underinsured motorist benefit.

If your vehicle is financed, the lending company will demand proof of auto insurance. They will examine to see if the protection you could have is matched with the amount wanted by the lending institution to fulfill the terms of the mortgage. The lending agency will also examine to see in the event that they’re famous as a loss payee. Your insurance coverage carrier will normally send a replica to the finance company, but you should at all times double verify to ensure it was obtained.

In May 2012, the Montana Highway Patrol began using the MTIVS net service to electronically verify proof of vehicle legal responsibility insurance coverage throughout visitors stops. Use of the web service assists troopers and motorists in situations the place drivers either can’t find their proof of insurance coverage card or have an expired card. The net service also gives troopers the ability to confirm the validity of a proof of insurance coverage card based on the response acquired from the issuing insurance company. Troopers can also use MTIVS to electronically confirm that liability insurance coverage was in impact at the time of an accident.

Most typically an accident entails a driver who’s “underinsured”. Underinsured motorist coverage only applies in case your uninsured coverage restrict is higher than the other driver’s legal responsibility. If you could have an insurance policy currently running for your automobile, you will want to make the present declaration data out there for your intended supplier. This serves as proof of current insurance and shows the insurance coverage company what kind of coverage you have in your automobile. Some insurance corporations can pull your insurance history without requiring a current declaration, however it’s a good suggestion to have it ready just in case.

Every time a change is made to an insurance policy, a declaration page is mailed or emailed on to you. Keep a watch out what is a declaration page for car insurance after you make your change, so you realize your change was correctly processed. Review the page to verify every little thing is listed accurately. Car insurance coverage periods sometimes final both six months or one yr. If you’re trying to get a better fee, you possibly can work with Policygenius to easily compare quotes from different insurers online.

What is a declaration page for car insurance policy look like?

What Is an Insurance Declarations Page? It incorporates your name and address, portrayals of the safeguarded property and your premium. It additionally traces your strategy’s inclusions, limits, deductibles, limits and applicable protection strategy structures and supports.

Uninsured/Underinsured motorist (UM/UIM) coverage covers medical and different expenses when you’re hit by a driver without sufficient auto insurance. Whether this coverage is obligatory or optionally available depends on your state laws. You should purchase further protection to pay for injury to your automotive if hit by an uninsured motorist, however many people instead simply buy collision and comprehensive.

Your automobile insurance coverage has a declarations web page which declares what coverages and limits you’ve chosen to purchase to guard yourself in case of an accident. Sometimes, an agent will check with this web page because the Dec Page. This page additionally explains how much you have to pay before your protection kicks in (the deductible). It’s all the time finest if you can depend on a personable and knowledgeable agent to go over this page with you.

By and large “full inclusion” contains crash inclusion and thorough inclusion. Collision protection is an elective add-on to complete – though it isn’t optionally available when you nonetheless owe cash on your car as a result of the finance firm or financial institution normally requires this coverage. Collision coverage could be a required a part of your automobile insurance coverage in case your car is financed or leased.

This identifies the policy quantity and provides necessary information together with the coverage term, protection limits, and information about the insured. It additionally contains a description of the automobiles coated under the policy. This insurance (State National) is offered by the credit union when we have not obtained acceptable proof of the required insurance coverage in your loan. This is not a substitute for normal insurance coverage.This is not going to provide liability protection for claims made towards you.

In some states, UMPD is on the market as a substitute for Collision protection. Liability insurance coverage – Pays for injuries to the opposite party and damages to the other vehicle ensuing from an accident you triggered. It additionally pays if the accident was caused by someone lined by your policy, including a driver operating your car along with your permission. In tennessee youre legally required to hold liability insurance coverage in case you get into an accident. Learn extra about our options and reductions and get a free online automotive insurance coverage quote now.

Simply put, a declarations page is a abstract of your auto insurance coverage. Typically, your auto insurance coverage firm will send you a coverage declaration each time you renew your automobile insurance coverage policy. While declarations look totally different from company to firm, they all have the same important bits of information about your protection. The Insurance Specialists at AIS work with a number of carriers and their brokers can help you, should you name .

Likewise, should you’ve finished paying off your automotive, you need to notify your auto insurance supplier. Make certain you receive an up to date what is a declaration page for car insurance that doesn’t listing any lienholder (in addition to a lien-free title from the lender).

It isn’t, however, designed to clarify your auto insurance coverage in exhaustive element. Instead, it’s a simple-to-learn abstract of your auto insurance protection. Imagine, for instance, that you just meant to include your spouse as a covered driver on your policy, however the declarations page doesn’t reflect that. If they get in an accident, your automobile insurance coverage won’t cover them.